To learn who your grant manager is for each grant , go to eGrants and select the “My. tab for contact information.

Organization of this guide. The Guide to Grants is organized along the grant lifecycle. To use this guide, click on the page number for the topic you are interested in and then use the navigation buttons at the bottom of the screen to return to the Table of Contents or move forward or backward in the guide.

The guide as a pointer system. This guide does not provide every rule or policy that governs your grant. It is meant to provide information about the most common issues and to point you to other source documentation that will allow you to develop a deeper understanding.

- Table of Contents

- Award2

- Contacting the Public Safety Office3

- Getting Started4

- Conditions of Funding5

- Payment Holds6

- Rules and Guidance7

- Grant Officials: Roles8

- Grant Officials: eGrants Actions9

- Report10

- Financial Reports and Payments11

- Programmatic Reporting12

- System for Award Management (SAM)13

- Manage14

- Financial Management15

- Unallowable Costs16

- Matching Contributions17

- Personnel Costs18

- Time and Effort Documentation19

- Contracts and Procurement20

- Equipment21

- Supplies and Other Direct Operating Expenses22

- Travel and Training23

- Indirect Costs24

- Program Income25

- Grant Adjustments - Process26

- Grant Adjustments - Approvals27

- Monitor28

- OOG Monitoring29

- Grantee Monitoring30

- Single Audits31

- Other Audits32

- Fraud, Waste, and Abuse33

- Reducing Risk34

- Close35

- Liquidation37

- Closing the Grant38

- Records Retention39

Grant Programs: The Office of the Governor’s Public Safety Office (PSO) is comprised of several programs that this Guide applies to: Border Security, Child Sex Trafficking, Crime Stoppers, Justice, Terrorism Preparedness, Victim Services, and the Sexual Assault Survivors' Task Force.

Primary contact: Each grant has a PSO staff member who is assigned as the grant manager. This person is responsible for oversight of your grant project and can help you with your questions and other needs. We recommend that you contact your Grant Manager directly by clicking on the Grant Managers name in eGrants under the My.Home tab. This action will automatically create an email in Outlook for your Grant Manager.

General contact information: You can contact us in a variety of ways:

| Contact Information | |

|---|---|

| PSO Main telephone line | (512) 463-1919 |

| Mailing address | Post Office Box 12428, Austin, TX 78711 |

| Physical address | 1100 San Jacinto Blvd., Austin, TX 78701 |

| eGrants Help Desk | eGrants@gov.texas.gov |

| Contact Us form | https://egrants.gov.texas.gov/... |

Announcement: All three grant officials—the authorized official, the financial officer, and the project director—will receive an email announcing the award.

Acceptance: The authorized official must accept the award. Only after acceptance can you begin activities and draw funds or take other actions in eGrants. This action must take place within 45 days of award. We recommend reading all award documents prior to accepting the grant; acceptance of the award indicates the grantee’s acceptance of all award conditions.

Commencing activities: Grant projects should be fully operational within 60 days from the start date of the grant award. If you cannot start grant activities before then, notify your grant manager. If the project is still not operational within 90 days without sufficient reason, the PSO can terminate the grant award.

Reporting: Within 30 days of the grant activation date, you must submit your responses to the questions on the General Assessment tab.

Obligating funds: Once you receive an award and accept it, you may begin obligating funds on your project start date, but not before. We cannot reimburse expenses obligated before the start date.

To review official grant documents and accept the grant, go to the “Accept Award” tab in eGrants to accept or decline the award.

Standard conditions. General grant conditions applicable to any award are included within the Standard Conditions and Responsibilities Memo attached to the award and found on the eGrants Summary/Award.Statement tab.

Federal fund-specific conditions. Federal funds often come with additional conditions that must be passed down to subrecipients. These conditions will also be attached to the award and can be found on the eGrants Summary/Award.Statement tab.

Special conditions. The PSO may also place special conditions on your grant award prior to or during the project period beyond those in the Standard Conditions. They are listed in the statement of grant award and on the eGrants Conditions.of.Funding tab. These conditions may come with a payment hold. See next slide for various types of payment holds.

Risk-based conditions. When the PSO finds that a risk exists because a grantee has not submitted required information or has not complied with an applicable statute, rule, regulation, guideline, or requirement, we may place a condition of funding on the grant, which may include a hold on funds.

Non-profit bonds. Each nonprofit corporation receiving funds must obtain and have on-file a blanket fidelity bond that indemnifies the PSO against the loss and theft of the entire amount of grant funds, including match. The cost of the bond is an eligible grant expense.

The PSO may temporarily withhold payments if a sub-grantee fails to comply with any term or condition of an award or when additional project information is needed.

Types of holds:

- Budget line-item (BLI) hold – May be placed on a single budget line item within

a grant when additional information is needed, or certain requirements must be met, before reimbursement can be made on the line item. Budget line-item holds are commonly placed pending submission of a Training Approval Review, Procurement Questionnaire, Environmental Planning and Historical Preservation Review, Interoperability Standards Statewide Interoperability Coordinator (SWIC) Review, or an indirect cost rate letter. (Instructions and forms related to these holds may be found within eGrants.)

- Fund hold (FH) – May be placed on an individual grant award when additional

information is needed, or certain requirements must be met, before ANY reimbursement can be made under the grant. Fund holds are commonly placed on a grant for an expired System for Award Management (SAM) registration, an outdated authorizing resolution, or High-Risk Designation.

- Vendor hold (VH) – Withholds all funds from the PSO to the grantee agency, regardless of the fund source. Vendor holds are commonly placed on an agency for delinquent progress reports, delinquent required Financial Status Reports (FSRs), missing single audits, unresolved monitoring findings, and other serious infractions as determined by the PSO.

Rules

Following are rules that may apply to your grant. In the event that any of these rules conflict, the more restrictive rule applies:

Applicable to all grants:

- Texas Administrative Code (TAC). Includes regulations issued by the State of Texas. Title I, Part I, Chapter 3 of the TAC specifically applies to the PSO.

- Texas Grant Management Standards (TxGMS). Includes regulations issued by the Texas State Comptroller’s Office. Applies to all grants and contracts funded with state funds.

Applicable to grants from a federal fund source:

- Uniform Administrative Requirements, Cost Principles, and Audit Requirements. Found in the Code of Federal Regulations, these rules are issued by the White House Office of Management and Budget. The PSO adopts these rules for all federally funded grants. Throughout the Guide to Grants, these rules are referred to as 2 CFR 200.

Guidance

In addition to the rules, there are other guides that may prove useful in managing your grants:

- eGrants Financial Management Guide. This guide will assist you in using eGrants to manage your grant funding.

- PSO General FAQs. A list of commonly asked questions in an easy-to-read question and answer format.

- DOJ Financial Guide. Issued by the Office of Justice Programs, US Department of Justice (DOJ). This guide is applicable to grantees receiving federal pass-through funds originating from DOJ and offers more in-depth information on common issues in grants and financial management.

- FEMA Information Bulletins and Policies. The US Department of Homeland Security’s Federal Emergency Management Agency (FEMA) has issued the Preparedness Grants Manual, and numerous information bulletins and policy statements related to common grant issues. These bulletins and policies are applicable to Border Security and Preparedness Program grantees receiving federal passthrough funds originating from FEMA.

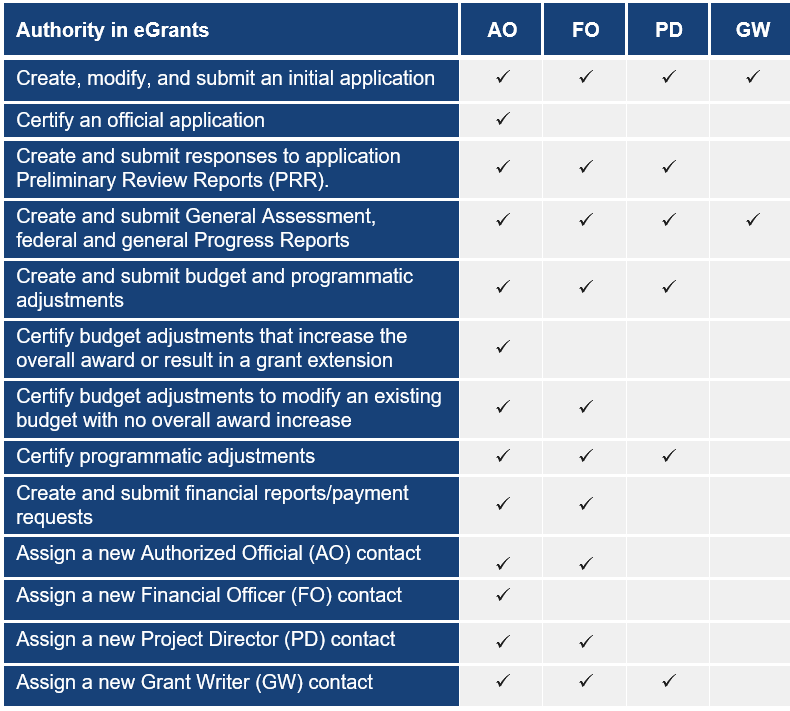

Each grant must have a project director, financial officer, and authorized official. No person can serve in more than one of these roles. Grant officials must not be related to each other by blood or marriage or have any relationship that creates an actual, potential, or apparent conflict of interest, nor can a contractor serve in the capacity of a grant official except for the Grant Writer.

The Authorized Official (AO) is usually a county judge, mayor, city manager, chairman of a non-profit board, head of a state agency, executive director, etc. They are authorized by the governing body of the organization to:

- apply for, accept, reject, alter, or terminate the grant; and

- certify changes made to applications or grants.

The Financial Official (FO) must be either an employee or board member and should be the Chief Financial Officer, Auditor, or Treasurer of the Board for the grantee agency. The employee or board member designated as the FO must have an in-depth understanding of the grantee’s financial tracking system as well as their obligations related to grant and match expenditures. They are responsible for:

- maintaining financial records to account for all grant expenditures and funds;

- requesting payments; and

- completing all required financial reporting at least quarterly.

The Project Director (PD) must be an employee of the grantee agency. They are responsible for:

- the day-to-day operations of the project; and

- required programmatic reporting.

The Grant Writer (GW) is responsible for:

- creating an application.

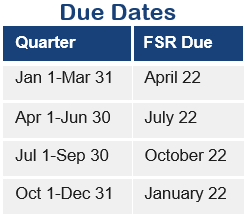

Frequency. Every quarter you must submit a required Financial Status Report (FSR) by the due date shown in the Due Dates table. This action meets both your quarterly financial reporting requirement AND triggers a payment to you. If your organization prefers more frequent payments, you may submit a FSR as often as once each month; this action will also meet your quarterly financial reporting requirement.

Contents. Expenses must be reported cumulatively from the start date of the grant through the current FSR reporting period. All expenses reported on the FSR must be actual costs incurred by the grantee during the period of performance (not estimates, accruals, or based on the budgeted amount), reported after-the-fact, and be supported by an approved budget line item in eGrants. Reporting of cash match and in-kind match should occur with each FSR in which expenses are sought for reimbursement.

Method. To submit a FSR see the eGrants Financial Management Guide or the FSR Instructional Video for detailed instructions.

Delinquent reports. If you do not submit a required quarterly FSR on time, your entire agency will be placed on vendor hold, meaning that no payments from the Governor’s Office will be made to your agency until the report is submitted.

10% Rule (May not apply to all HSGP or NSGP programs). In certain budget categories you may report expenditures in excess of the budgeted amount, as long as you do not exceed 10% of the OOG award amount – this is called the 10% Rule. Note: This rule does not apply to the Equipment or Indirect Cost budget categories; any changes to items in these budget categories must be approved through a budget adjustment prior to requesting reimbursement.

To submit an FSR, go to eGrants and from the My Home tab click on the grant record, then choose the Budget tab and click on the Financial Status Report sub tab.

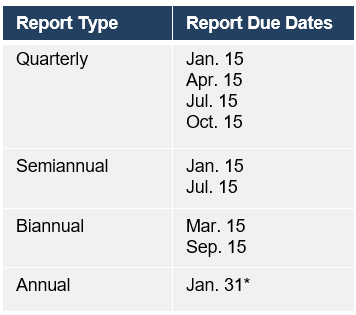

Requirement. Grantees must report their progress in meeting the goals, objectives, and measures of their grant. (1 TAC §3.2527)

Method. Most progress reporting will occur within eGrants on the Summary/Progress.Reports.General and Summary/Progress.Reports.Federal tabs. Grantees with federally funded awards will submit both a General and a Federal Progress Report. Grantees with state-funded awards will submit a General Progress Report. Some exceptions may apply and will be communicated in writing.

Frequency. The number of reports and the due dates depend on the funding source for your grant. The reporting tabs in eGrants indicate the type of reports applicable for each funding source and grant. See the table below for the due dates by report type. Note also that some grant awards may require more frequent reporting. *Some grant programs may have an alternative due date.

The majority of grant programs require a SAM registration:

- Federal funds. All awards that come from federal sources must maintain a SAM registration throughout the life of the grant. No payments can be made to grantees under federal sources without a valid registration.

- State funds. Most awards that come from state sources must have a SAM registration at the time of application, which must be valid at the time of award. Note: Crime Stoppers programs do not require SAM registration.

- Guidance. The requirement for SAM is included in the Request for Applications for each program or funding source.

- Updates. If the grantee updates the SAM registration and receives a new expiration date on the federal SAM website, they must also submit a grant adjustment through eGrants to update the SAM expiration date on the grant record.

A grantee’s internal financial management system and practices, including documentation, must:

- Identify awards. The system must identify, in its accounts, all grant awards received and expended as well as the source and application of funds for grant- funded activities. These records must contain information pertaining to awards, authorizations, obligations, unobligated balances, assets, expenditures, income and interest, and be supported by source documentation. Accounting systems must be able to account for award funds separately.

- Report. The system must be sufficient to provide for accurate, current, and complete disclosure of the grant’s financial results, prepare required financial status reports, and trace funds to a level of expenditures adequate to establish that the funds have been used according to the rules and requirements of the grant.

- Exercise controls. The system must enforce effective control over, and accountability for, all funds, property, and other assets. It must also adequately safeguard all assets and assure that they are used solely for authorized purposes.

- Manage budget. The system must provide for comparison of expenditures with budget amounts for each grant and include written procedures for determining the allowability of costs.

The Request for Applications for each grant program may set out additional unallowable costs; however, there are some costs that are never allowed:

|

|

Required match. If the fund source requires matching funds on a grant, the grantee must ensure that it possesses or can acquire the required matching funds. A third-party (e.g., contractor or participating entity/partner) may contribute toward the matching funds requirement but the applicant bears the responsibility for satisfying the matching funds requirement. The match source for a federal award may not be satisfied by a different federal award.

Cash match expenditures. Actual non-OOG cash spent by the grantee on eligible items included within the approved eGrants budget. Must be supported with verifiable documentation as otherwise used to support reimbursed costs.

In-kind contributions. If a program allows for in-kind contributions, the fair market value of goods and services must be documented and supported by the same methods otherwise used to support reimbursed costs. In-kind contributions must be donated to the grantee by a third party (employees and board members of the grantee are not considered third parties). Volunteer time on grant-related activities may be used as in-kind match, but rates must be consistent with those paid by the grantee for similar work and may not be provided by paid employees or board members of the grantee.

Applicable rules and policies. Matching funds are part of the overall total project budget and are considered grant funds. As a result, all rules and policies that apply to the OOG award amount also apply to the matching funds. Match contributions may only be used for eligible, approved budget items that are necessary and reasonable to accomplish project objectives. These policies apply to both the required match and any voluntary overmatch.

Depreciation. A portion of depreciation for fixed assets (i.e., buildings or equipment) is allowed as in-kind match. The maximum depreciation allowable is the amount that occurs during the grant period. The straight-line depreciation method (with or without the salvage value) must be used to calculate depreciation; you cannot use an accelerated method to calculate depreciation. You cannot claim both depreciation and use allowance for using the item. For example, if you own a building and choose to report the depreciation, you cannot also claim use allowance for the building.

Use Allowance for Buildings. Multiply the acquisition cost of the building by the applicable use allowance. For example: A building is purchased for $100,000. The use allowance is 2% of the purchase price. Calculate the annual use allowance for the building as follows: $100,000 x 2% = $2,000. The use allowance would be $2,000 for the use of the building during the grant period.

Salary level. Compensation for grant-funded employees must be comparable to that of non-grant funded employees performing similar work duties. Compensation typically includes wages or salary as well as employer paid taxes and fringe benefits. The employer-paid portion of fringe benefits are an allowable expense. Some common types of fringe benefits include: life, disability, and health insurance; unemployment taxes; workers compensation; tuition reimbursement; education assistance; and retirement plan contributions. Allowable fringe benefits are those that are supported by a written policy that applies to both grant and non-grant staff.

Leave payouts. Grantees may use grant funds to compensate grant-funded staff members leaving employment with accrued leave (which includes, but is not limited to, annual leave, compensatory time, and sick leave) in accordance with the grantee's written policy. Grant-funded employees must be treated consistent with non-grant funded employees, and accrual payouts can only be charged based on time spent working on the grant. These payments may only fund leave earned during the current grant period. The proportion of grant funds paid for leave cannot exceed the proportion of grant funds used to pay the staff member's salary (if the employee is paid from OOG funds at 50% of full time, then the grant can only provide 50% of the leave payout).

Severance pay. Grantees may use grant funds to provide severance pay to employees who, through no fault of their own, were terminated, furloughed, laid off, retired, took early retirement, etc., and when payments are in accordance with the grantee’s written policy. Costs of severance pay must be allocated to all projects on which the employee was funded during the current grant period and must be based on normal severances over a representative past period. Grantees must seek prior approval from PSO for abnormal or mass severance pay.

Unallowable cost. The PSO will not pay any portion of the salary of, or any other compensation for, an elected or appointed city, county, or state government official (e.g., Sheriff, Constable, Treasurer, etc.).

Overtime. Overtime is allowable to the extent that it is included in the approved budget, the grantee agency has a written overtime policy approved by its governing body, and both grant-paid and non-grant paid personnel are treated the same with regards to the application of overtime policies. The approved overtime policy should be part of the grant application. In no case is dual compensation allowable. That is, an employee of a grantee agency may not receive compensation for hours worked (including paid leave) from his/her agency AND from an award for a single period of time, even though such work may benefit both activities. The PSO will only reimburse the grantee for overtime that does not exceed a total of 16-hours worked (regular plus overtime) during any 24-hour period. Overtime payments issued outside of these guidelines are the responsibility of the subrecipient agency.

On-call time. On-call hours for employees should not be included in physical hours worked or as eligible hours for overtime. Time recorded for on-call hours should be maintained in accordance with grant time and effort documentation requirements. The maximum hourly rate charged to the grant cannot exceed 50% of the employee’s regular hourly rate. If the governing board has established a lower rate, then the lower rate must be used. On-call services for volunteers may be used to meet match requirements when on-call services are necessary to carry out the mission of the project. The lowest comparable employee rate must be used to determine the 50% volunteer rate. The budget line-item description should clearly indicate if the employee or volunteer provides on-call services. Grantees must have a board-approved on-call policy that specifies how employees are compensated for on-call services and must provide a copy upon request. Employees claiming on-call time must be compensated in accordance with the grantee's internal policy, and that time is eligible to be charged to the grant or claimed as cash match only.

Self-Funded Grantees. For benefits provided by the entity itself (self-insured), the grantee should ensure to maintain on file:

- Descriptions of the types of insurance provided by the grantee (e.g., health, dental, life, disability, worker’s compensation, etc.);

- Procedures or methodology followed by the entity for determining self-insured rates (employer and employee portions);

- Policy and procedures on how self-insurance works and how it is tracked in the accounting system;

- A list of insurance benefit policies offered, and rates assigned for employee and employer;

- Report(s) used to determine rates (i.e., Internal and Actuarial Analysis);

- Proof of purchase & payment for Stop Loss Insurance; and

- Signed minutes (board/committee or other) showing approval of the rates and effective period(s).

When reporting Overtime expenses for a border security or preparedness grant on an FSR you must complete and upload a Personnel Overtime Summary Form for each overtime line item. (Under “Forms”)

Determination of costs. Personnel costs, including cash match and in-kind contributions, must be based on records that accurately reflect the work performed (grant and non-grant), actual cost paid out (wages, overtime, etc. as well as, employer paid taxes and fringe benefits), and comply with the established policies and practices of the organization and the grant.

Internal controls. Charges must be supported by a system of internal controls which provides reasonable assurance that the charges are accurate, allowable, and properly allocated. Per the Fair Labor Standards Act (FLSA) nonexempt employees must maintain timesheets indicating the total number of hours worked and any leave taken each day. If the agency excludes exempt employees from completing a timesheet, written policies and procedures stating this should be in place.

100% on a single grant. Employees working solely (100% of their time) on a single grant must certify (via employee effort certification form, timesheet, or time and activity reports) that the employee worked solely on that grant project. If via certification, this form must be prepared at least on a semi-annual basis and be applicable to the grant period. If via timesheet or time and activity reports, the certification should appear on every applicable form.

Less than 100% on a single grant. Any employee who is not working solely on the grant (e.g. works on more than one grant, a grant and non-grant activity, an indirect cost activity and a direct cost activity, two or more indirect activities which are allocated using different allocation bases, or an unallowable activity and a direct or indirect grant activity) must keep time and activity reports

recording all hours worked and allocated by funding source (regardless of internal policy, this requirement also applies to exempt employees when they are less than 100% funded). (See “Grantee Personnel Time and Activity Report Requirements”). These reports should be developed to coincide with each pay period (preferably) or at minimum monthly.

Documentation. All timekeeping records (timesheets, time and activity reports and certifications) must be signed (manually or electronically) by the employee and a supervisory official having firsthand knowledge of the work performed, and the documentation must be incorporated into grantee’s official records. Grantees must have written procedures in place when the agency allows employees and/or supervisors to sign documents electronically. Salaries and wages of employees used in meeting cost sharing or matching requirements on Federal awards must be supported in the same manner as salaries and wages claimed for reimbursement from Federal awards.

Overtime grants. Entities receiving grant funds for overtime must maintain time and activity reports for all time physically worked. The reports must contain information which substantiates that OT charged to the grant follows the agency’s OT policy as well as any federal, state, or OOG policies.

Contract management. Grantees must establish a contract administration system to consistently ensure that contract deliverables are being provided as specified in the contracts.

Contract monitoring. Part of contract administration includes contract monitoring. The general premise of contract monitoring is for the grantee to ensure that the vendor is fulfilling the deliverables specified in the Scope of Work or, said another way, providing the services for which they are paying. A monitoring plan should include who will perform the monitoring, what will be monitored (at minimum, the Scope of Work), the frequency of monitoring, documentation that will be maintained to confirm that monitoring has been conducted, and the location of that documentation. The plan may provide general statements that contract monitoring will be conducted and that checklists or specific monitoring requirements will be developed for each contract. When this type of monitoring plan is developed, the plan should include an example of each checklist that will be used. Please note that monitoring is more than confirming the accuracy of the invoice.

Procurement. Grantees must use established procurement policies that are in line with applicable local, state and federal laws and regulations.

Larger procurements. A grantee must submit an OOG-prescribed Procurement Questionnaire prior to obligating funds when any procurement from a single vendor is expected to exceed the Simplified Acquisition Threshold (SAT) or upon request. The PSO may also request all related procurement documentation, such as requests for proposals, invitations for bids, or independent cost estimates. This requirement applies to the procurement or purchase as a whole and is not dependent on the amount charged to a specific grant. For example, if a purchase or contract exceeds the SAT and the costs for that purchase/contract are split among multiple grants, the Procurement Questionnaire requirement is still applicable. Grantees may not divide purchases or contracts on the eGrants budget, or between multiple grants, to avoid the requirements of this section. For purposes of determining compliance, the PSO will consider groups of contracts with a single vendor or groups of purchases for the same or similar items as a single procurement.

The procurement questionnaire can be found in eGrants by going to the eGrants home page > Updates > Forms

Definition. Tangible personal property (including information technology systems) having a useful life of more than one year and a per-unit cost of $10,000 or more, or less if the grantee chooses to capitalize items costing less.

State-Controlled Assets. The following items valued between $500.00 and $4,999.99 are designated by the Texas Comptroller as controlled assets within the State Property Accounting guidance and must be maintained within the grantee’s inventory records: sound systems and other audio equipment; cameras; TVs; video players/recorders; desktop or laptop computers; data projectors; smartphones, tablets and other handheld devices; and unmanned aerial vehicle drones. The PSO has also designated ballistic shields and mobile and portable radios as controlled assets.

Use. Equipment must be used by the grantee in the program or project for which it was acquired as long as needed, whether or not the program or project continues to be supported by grant funds. After the program has closed, and when the equipment is no longer needed for the original program or project the agency may need to request disposition instructions.

Inventory. The PSO requires each grantee to maintain written procedures for managing equipment and maintaining an up-to-date inventory report. Grantees must maintain a current inventory report with property records for all equipment and state-controlled assets (as defined above), as well as items capitalized by the grantee, that were purchased with grant funds during the grant period. The following elements must be included within the property records: description of the property; serial number or other ID number; source of funding including the OOG-issued grant number and the Federal/State Award Identification Number (FAIN/SAIN); title holder; acquisition date; cost of property; percentage of the property’s cost paid with grant funds; location; use; condition (does not mean ‘new’ or ‘used’; see PSO General FAQ for condition types); and disposition data, including the date of disposal and sale price or fair market value if item is not sold.

Physical Inventory. A physical inventory of the property must be taken and the results reconciled with the property records as least once every two years.

Control System and Maintenance. A control system must be developed to ensure adequate safeguards to prevent loss, damage, or theft of the property. Any loss, damage, or theft must be investigated. Adequate maintenance procedures must be in place to keep the property in good condition.

Disposition. When equipment acquired under an award is no longer needed for the original project or program or for other activities supported by the federal* awarding agency, the grantee may need to request disposition instructions from the OOG using the Equipment Disposition Request form. Items with a current per unit fair market value less than $5,000 (awards with a start date prior to 10/1/2024) or $10,000 (awards with a start date on or after 10/1/2024) may be retained, sold, or otherwise disposed of with no further obligation to the Federal awarding agency or OOG.

*For equipment funded under a state award, when the equipment acquired with state funds is no longer needed for the original project or for other activities supported by an award from the OOG, the grantee may need to request disposition instructions.

Supplies. The PSO defines supplies as tangible personal property, including general office supplies and project supplies, with a per-unit cost of less than $10,000, unless the grantee agency chooses to capitalize the item, in which case it would be considered equipment. Supplies which are considered state-controlled assets must be listed on the equipment inventory list.

Other Direct Operating Expenses. This budget category includes other direct costs such as leases for space, rental costs, advertising costs for staff vacancies, utilities, cell phones, liability insurance, payroll services, vehicle operating costs (e.g., fuel and maintenance), intangible property such as software and software licenses, etc.

Cost Allocation Methodology (CAM). A grantee may develop a CAM to equitably distribute costs among its various funding sources based on factors such as FTE ratios, square footage, usage rate, etc. The CAM must be written and approved by the entity’s Executive Director or Chief Financial Officer and be consistently applied to all costs specified in the CAM. For public entities, this methodology is referred to as a Cost Allocation Plan (CAP). The CAP operates the same as a CAM and is written by the entity’s Chief Financial Officer, Treasurer, or Auditor and approved by the entity’s governing board (Board of Directors, City Council, etc.) The methodology included in the CAM or CAP needs to be supported by auditable documentation to determine accuracy in the allocation of costs to each fund source.

Travel policy. Grant funds used for travel expenses must be limited to the grantee agency's established mileage, per diem, and lodging policies. If a grantee does not have such written policies, then the grantee must use the State of Texas travel guidelines. Keep the following policies in mind:

- You must select the lowest comparable air rate. The PSO will not reimburse for business or first-class travel.

- Foreign travel requires prior approval from the PSO.

- Travel expenses must be directly related to the purpose of the grant

- Travel costs should only be claimed for agency employees. Travel for contractors should be included as part of the individual’s contract or claimed under supplies and Direct Operating Expenses (DOE).

Training courses, conferences and meetings. Grantees must maintain records that properly document attendance at conferences and completion of all grant-funded training courses. For formal training classes and courses, a certificate of completion must be retained along with other supporting documentation. For conferences, workshops, symposiums or other meetings where completion certificates are not issued, the following are some examples of acceptable documentation: Sign-in sheets; copies of travel vouchers (listing the purpose of travel/trip) along with the conference flyer, program or meeting agenda; emailed verification of attendance from the conference/meeting host; or meeting minutes that include a list of attendees.

Homeland Security training. Grantees requesting to offer or attend training using Homeland Security Grant Program (HSGP) or Nonprofit Security Grant Program (NSGP) funds must receive approval from the PSO and the Texas Training Point of Contact employed by the Texas Division of Emergency Management to ensure it falls within the FEMA mission to prepare personnel to prevent, protect against, mitigate, respond to, and recover from acts of terrorism and catastrophic events and the jurisdictions Emergency Operations Plan. A Homeland Security Training Review Form must be completed to begin the review process.

Allowability. Some funding sources allow for indirect costs in accordance with applicable state and federal guidelines. Indirect costs must be approved in the Statement of Grant Award.

Approved rates. If the applicant has an approved indirect cost rate from either their federal or state cognizant agency and wishes to charge indirect costs to the grant, the applicant must identify the indirect cost rate and provide the Negotiated Indirect Cost Rate Agreement (NICRA), including any information needed to understand the basis for the rate.

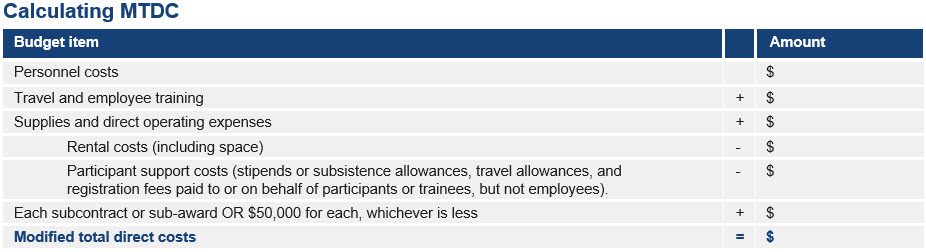

De minimis rate. If the applicant does not currently have a federally recognized or state approved indirect cost rate, the PSO may approve indirect costs in an amount not to exceed fifteen percent (15%) of the approved modified total direct costs (MTDC). Calculating the MTDC should be performed when developing or adjusting the grant budget and prior to submitting each FSR. Indirect costs, equipment, capital expenditures, rental costs, charges for patient care, tuition remission, and scholarships and fellowships should be excluded when calculating MTDC.

Definition. The PSO defines program income as gross income generated by an activity supported by a grant. Such activities are most commonly participant fees.

Treatment of program income. Earned program income must be added to the approved budget through a grant adjustment and reported as expended in a financial status report prior to expending OOG funds. In addition, earned program income must be recorded in the grantee’s financial management system and clearly delineated as such.

Applicable rules and policies. Program income is part of the overall total project budget and are considered grant funds. As a result, all rules and policies that apply to the OOG award amount also apply to the program income. Program income contributions may only be used for eligible, approved budget items that are necessary and reasonable to accomplish project objectives.

Use of income. Program income may only be used for allowable project costs as reflected in an approved grant budget. There are three methods for accounting for program income:

- Deduction. Program income is deducted from total allowable costs by reducing both OOG award amount and any grantee match in proportion. Grantees must use this method unless a different method is approved by OOG and documented in eGrants.

- Addition. Program income is added to the total project costs and must be used for the purposes and under the conditions of the grant.

- Cost sharing or matching. Program income is used to meet the cost sharing or matching requirement of grant.

Nature of adjustments. Adjustments are generally intended to respond to unexpected events and changes that affect grant projects. Grantees should attempt to anticipate, plan, and budget for costs in their grant application.

Adjustments requested in the last 30 days of a project period will receive special scrutiny.

Initiating an adjustment. The project director, financial officer, or authorized official may submit requests for grant adjustments through eGrants. Adjustments are subject to approval by the PSO, and grantees who expend funds prior to approval do so at their own risk – they are not guaranteed for reimbursement. Note: Features are available on the My.Home tab that allow you to update grant officials or the SAM expiration date on multiple grant records at the same time.

To submit a grant adjustment request, go to eGrants then click on the Budget tab and then the ‘Request Adjustment’ sub tab.

Grant officials can update their individual phone numbers, addresses, title and position on the My.Profile tab in egrants. This action does not require a grant adjustment.

eGrants Video: Make Changes Using the Grant Adjustment Process

Types of adjustments. The following changes to your grant require approval from the PSO via an adjustment request in eGrants unless the cost was approved in the award:

- Grant Officials. A new project director, financial officer or authorized official.

- Identifying Information. A change to the agency name, project title or address.

- Program Information. Any change to the project’s approved scope or objective.

- Grant Period. A change to the grant end date.

- Budget changes. Termination/hiring of staff; changes to the percent of time spent on grant activities; the addition of new line items; deviations to the approved project budget that would cause the actual expenditures to vary from the approved budget in amount that exceeds 10% of the total OOG budgeted amount; or any deviations to the following (regardless of actual expenditure):

- Equipment. Any increase in the expenditure amount or change in the quantity and/or type of equipment.

- Indirect Costs. Any change in the rate or increase in the expenditure amount.

- Consultants/Contractors. Any consultant or contractor rate that exceeds $650 per day or $81.25 per hour.

- Foreign travel. All travel outside of the United States.

- Confidential funds. Any funds used by law enforcement to pay confidential informants, purchase evidence or specific information, or related services.

- Program income. A change to add earned generated program income (GPI) to the approved budget.

- Failing to obtain approval for any of the above prior to receipt of a grant payment from the OOG could result in the grantee owing a refund to the OOG.

Overview. The OOG has oversight responsibility for the grants it awards. Monitoring may consist of programmatic reviews, financial reviews, technical assistance, or formal audits commissioned by the PSO or the Office of Compliance and Monitoring (OCM) within the Office of the Governor. The PSO or OCM may conduct monitoring through an on-site review at the grantee’s location or through a desk review.

Documentation and inquiries. The PSO or OCM may request grantees to submit information needed to conduct a monitoring review. Grantees must maintain and make available all records relevant to a monitoring review upon request. Inadequate or incomplete documentation may result in disallowed costs or other remedies for noncompliance such as fund or vendor hold or deobligation of grant funds.

Follow up. After a monitoring review is complete, the grantee will receive either a preliminary report or a final report. If a preliminary report is issued, it will outline identified findings along with corrective actions to resolve the findings.

Response. For programmatic monitoring reviews conducted by the PSO, the grantee must complete any required actions within the timeframe specified in the report. For financial monitoring reviews conducted by OCM, the grantee must respond to the preliminary report with a management response that addresses the finding(s) included in the report. This management response must be provided to the monitor/auditor within the timeframe specified in the report. A corrective action plan shall include:

- the titles of the persons responsible for implementing the corrective action plan;

- the corrective action to be taken; and

- the anticipated completion date.

Disagreement. If the grantee believes corrective action is not required, the management response must provide an explanation of the specific reason(s). The PSO or OCM will determine whether the response is adequate.

Final report and resolution. The grantee's management response and the approved corrective action plan will become part of the final report. The grantee shall resolve all identified findings within the time specified by the PSO or OCM. Failure to respond by the due date may result in sanctions.

Monitoring and Oversight of Grant Activities. Grantees have their own monitoring responsibilities. They must:

- Regularly evaluate their projects, including any contracted services;

- Monitor the day-to-day operations of grant and sub-award supported activities, including those of their contractors and subcontractors per their contract monitoring plan;

- Develop and maintain a written standardized monitoring program incorporating best practices; and

- Maintain written documentation supporting monitoring conducted by the grantee in their project files for inspection during a PSO or OCM monitoring review.

Requirement.

- Grantees that expend $1,000,000 or more in combined federal grant funding, during the entity’s fiscal year, or $1,000,000 or more in combined state grant funding, during the entity’s fiscal year, must submit a Single Audit reporting package. This requirement is only applicable for grantees whose 2024 FYE ends on or after October 1, 2024. If the grantee’s FYE ends prior to October 1, 2024, the threshold amount is $750,000 of combined federal grant funding or $750,000 of combined state funding.

- All other grantees who are not required to have such an audit for any fiscal years in which the OOG award was made or expended, must certify this fact to the Office of Compliance and Monitoring (OCM). A Certification of Single Audit Reporting Requirement Exemption form is available on the eGrants website and must be submitted within 60 days of the end of the grantee’s fiscal year to OCM-FMU@gov.texas.gov.

Reporting. Grantees required to perform a Single Audit must submit the required Single Audit reporting package within 30 calendar days of receiving the Single Audit report from the independent auditor or 9 months after the end of the audit period, whichever is earlier.

- For grantees expending $1,000,000 or more in federal grant funds: reporting documentation must be submitted to the Federal Audit Clearinghouse at http://harvester.census.gov/sac/ and to the Governor's Office of Compliance and Monitoring (OCM) at OCM-FMU@gov.texas.gov.

- For grantees expending $1,000,000 or more in state grant funds: reporting documentation must be submitted to the Governor’s Office of Compliance and Monitoring (OCM) at OCM-FMU@gov.texas.gov.

Other audits. All other audits performed by auditors independent of the PSO or OCM must be maintained at the grantee's administrative offices and be made available upon request.

Audit Confirmation Letters. Requests for confirmation of grant payments from the OOG (audit confirmation letters) should be sent to the OOG Financial Services Division (FSD).

Requests via email are preferred and should be submitted to: accounting@gov.texas.gov. If email is not feasible, requests may be made in writing to the following address:

Office of the Governor

Attn: FSD

P.O. Box 12878

Austin, TX 78711-2878

Adverse findings. Grantees must notify the PSO of any audit results that may adversely impact grant funds.

Most common types of fraud. Most cases of fraud fall into one of these categories:

- Conflict of interest. No one involved with a grant can participate in any decisions, approvals, disapprovals, recommendations, decisions, or other action if it concerns or benefits family members, a partner, any organization they serve in an official capacity, or any organization they are considering employment with.

- Failure to Properly Support the Use of Award Funds. Typical issues involve deliberate redirection of funds in a manner different from the purpose outlined in the award agreement or failure to adequately account for, track, or support transactions.

- Theft. This is the most common issue. Keep in mind that people who embezzle funds can be extremely creative, while often appearing very trustworthy. These abilities are precisely why they can do so much damage to an organization and remain undetected for extended periods of time. Poor or no internal controls provide an opening for theft. A lack of proper separation of duties is one of the most common organizational vulnerabilities.

- Criminal or licensing violations. While not as common as other types of fraud, failing to report a criminal or licensing violation by an employee, officer, contractor, or anyone with an official relationship with the grantee, is a form of fraud. Any grantee who becomes aware of such an investigation by a law enforcement agency or state or federal licensing agency must disclose it immediately.

Mandatory disclosures. Grantees and applicants must immediately disclose all violations of federal or state criminal law involving fraud, bribery, or gratuity violations potentially affecting the grant award in writing to the PSO. Failure to make required disclosures can result in grant sanctions including termination of the award.

Reduce the risk. There are several things that you can do to reduce the risk of fraudulent use of your grant funds:

- Controls. Examine your operations and internal controls to identify your fraud vulnerabilities. Maintain a well-designed and regularly tested system of internal controls that is documented in written policies and procedures.

- Education. Implement specific fraud prevention strategies including educating employees, board members and all others associated with the organization about the risks. The more people are aware of the issues, the more they can help prevent problems or detect them as early as possible.

- Documentation. Ensure all financial or other certifications and progress reports are adequately supported with appropriate documentation and evidence.

- Conflicts of Interest. Identify any potential conflict-of-interest issues and disclose them to the awarding agency for specific guidance and advice.

- Fair procurement. Follow a fair and transparent procurement process, especially when using consultants. Ensure that the rate of pay is reasonable and justifiable, and that the work product is well-defined and documented.

Liquidation period. The liquidation date is specified in an original grant award or a subsequent grant adjustment and is generally 90 days after the end of the project period.

Liabilities. Grantees must expend all outstanding liabilities no later than the liquidation date. All payments made after the completion of the grant period must relate to obligations incurred during the grant period.

Financial reporting. The liquidation date is the final date you can report expenses that were obligated during the grant period. A required Final FSR is due in eGrants on or before the grant liquidation date. Failure to submit a Final FSR by the liquidation date will result in the Governor’s Office holding reimbursement for all grants to your agency. Note: Equipment, supplies and other tangible items may be received by the agency and the vendor paid during the liquidation period, as long as the expense was incurred during the period of performance.

Deobligation. Funds not obligated by the end of the grant period and not expended by the liquidation date will revert to the OOG.

The grant start date, end date and liquidation date can be found on the eGrants “Profile-Details” tab or the header of each tab in eGrants.

To submit an FSR, go to eGrants and from the My Home tab click on the grant record, then choose the Budget tab and click on the Financial Status Report sub tab.

There are several steps needed to close your grant:

Final progress report. Submit your final progress report. Once your report has been approved by the PSO, your grant will be considered programmatically closed.

Final FSR. Once you have expended all obligations, submit the final FSR that includes all cumulative expenses incurred under the grant. This report can be submitted at any time but must be submitted by the liquidation date.

Generated program income (GPI). If the grant project earned program income, the final FSR must demonstrate that all budgeted GPI has been expended or returned to the OOG. If you have earned program income that is not reflected in the approved budget, you must initiate a grant adjustment to add the additional GPI before submitting your final FSR. If the program income exceeds the amount of OOG- funded line items, you will be required to return the balance.

Equipment use. In your final FSR, for each piece of equipment, let the PSO know how the agency plans to use the equipment or the process planned for disposal if the item is no longer operational or needed for similar purposes. The PSO may request additional information or direct the grantee to take further action, including requiring a grantee to transfer equipment to another agency.

Monitoring Issues. All outstanding findings or corrective action plans from financial or programmatic monitoring must be resolved.

Cash on Hand. Cash on hand exists when the total amount of reimbursements paid to date exceed the total amount reported as expended to date. The grantee must promptly return any cash on hand to the OOG.

To submit an FSR, go to eGrants and from the My Home tab click on the grant record, then choose the Budget tab and click on the Financial Status Report sub tab.

Core requirement. Grantees must maintain all financial records, supporting documents, statistical records, and all other records pertinent to the award for at least three years following the closure of the most recent audit report or submission of the final financial status report if the audit report requirement has been waived. Grantees may retain records in an electronic format. All records are subject to audit or monitoring during the entire retention period.

Equipment. Grantees must retain records for equipment, non-expendable personal property, and real property for a period of three years from the date of the item's disposition, replacement, or transfer.

Further actions. If any litigation, claim, or audit is started before the expiration of the three-year records retention period, the grantee must retain the records under review until the completion of the action and resolution of all issues which arise from it or until the end of the regular three-year period, whichever is later.